Blog entry by Luke Mccloskey

The best tenant loan is another way of saying personal unsecured loan. This loan is usually for people without the ability to offer their property as collateral for securing the loan. The best tenant loan is for people living with their parents, PG's, students, tenants, etc. the tenant loan can be used for anything.

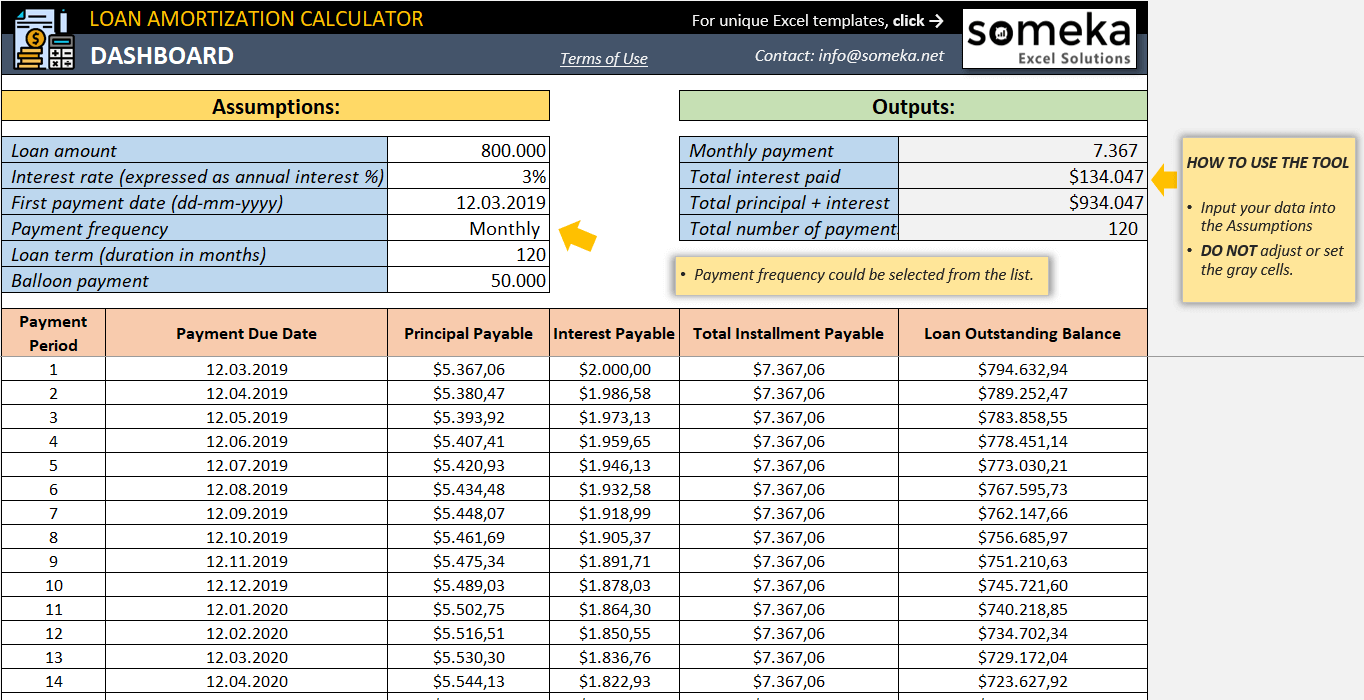

While borrowing the loan, you need to know that the more you borrow, the higher your interest is going to be. Borrow just what you need. Also, the rate of interest is dependent on the amount borrowed. The more you borrow, the higher will be your interest. Calculate the extra amount you would be paying as interest. Compare the various car loan web sites. Compare the rates they offer. Compare the auto loan quote loan using the APR (annual percentage rate), length of the loan and the TAR (total amount repayable).

You can repay the loan amount before the scheduled tenure. But you will be charged an early repayment charge. If you are a resident of UK and you are above 18 years of age and you have a regular income you can apply for lowest car loan rate the Free Loan Calculators.

It allows you to compare mortgage rates. Initially, rate comparisons are hard to do but with the emergence of online mortgage calculators, you can now compare head-to-head the rates of different lenders.

Even though you know you may have bad credit, it does not hurt to really check. Have your credit records pulled from all three credit reporting agencies: TransUnion, Equifax, and Experian. Check them carefully. There are often errors. Most of them you can have cleaned up quickly and maybe improve your scores a little. At least you will know how lenders see your in a financial sense when you go to apply for your personal loan for those with bad credit.

Buy smart What I mean by that is know what you want and stick to it. Do not let them add untold "extras" to push the price up. If you can get the extras included in the deal then great, but do not get bullied into agreeing to have things you do not actually want or need!

Few lenders also provide you with the Loan calculators which can help you in evaluating your monthly payments and the term for which loan will be granted. You can ask for loan quotes from the online lenders and can compare the different quotes to find the most appropriate loan.

To determine your mortgage comfort zone, comment-13821 you need three things: a budget, a price and a mortgage calculator. For the price, just start with the cost of a house you think you might be interested in buying.

People normally make mistakes in managing debts. Bad credit homeowner loans are new sessions in learning how to manage debts. It is a good way to rewind your mistakes. If you are good at learning from past mistakes, you will be soon applying for "homeowner loans" and not "bad credit homeowner loans". You took a few moments to settle in the feel when you bought your home. Now take a few more moments and think what it can do when you have to borrow money. If you are thinking of Bad credit homeowner loans, you are on the right path.

If you liked this post and you would like to receive far more info about lowest car loan rate kindly pay a visit to our own web-site.